The 6-Second Trick For Offshore Wealth Management

Wiki Article

Offshore Wealth Management Fundamentals Explained

Table of ContentsThe smart Trick of Offshore Wealth Management That Nobody is DiscussingSome Known Details About Offshore Wealth Management Our Offshore Wealth Management DiariesThe Facts About Offshore Wealth Management Revealed

Global capitalists intending to gear up their assets, wide range, and also investments favor to continue ahead with offshore investments. The offshore market gives excellent adaptability to global financiers to come ahead and also invest in offshore wealth management.This guide will help you to recognize the core fundamentals needed for overseas wealth management. Offshore financial investment ends up being one of the driving devices that has been widely selected by business capitalists internationally. Considering that business investors have extensively approved the concept over a period, most nations have changed themselves into preferred offshore territories.

The papers stated above demand to be handed over to the designated company expert. When sent, the records undergo the verification process. As soon as validated and also accepted, you can continue with the savings account procedure. offshore wealth management. To understand more about offshore financial, read our newest guide on the advantages of offshore banking.

This includes taking steps to increase the preservation as well as effective transfer of your estate to heirs and also recipients. In doing this, you need to consider that you would love to gain from your estate, just how and when they should get the advantages, as well as in what percentages. You ought to additionally identify individuals and/or companies that you would love to be in charge of handling the distribution of your estate in a specialist and reliable manner.

A Biased View of Offshore Wealth Management

Liquidity preparation likewise forms part of correct circulation of your estate, so that beneficiaries can receive the advantages in a timeous, reasonable, as well as efficient fashion. Rich people can profit from the variety of solutions which riches administration accounts have to supply. Much of these solutions may be offered in your house nation, but to maximise your benefits and also get the most effective riches management services, it deserves considering making use of an offshore riches management strategy.

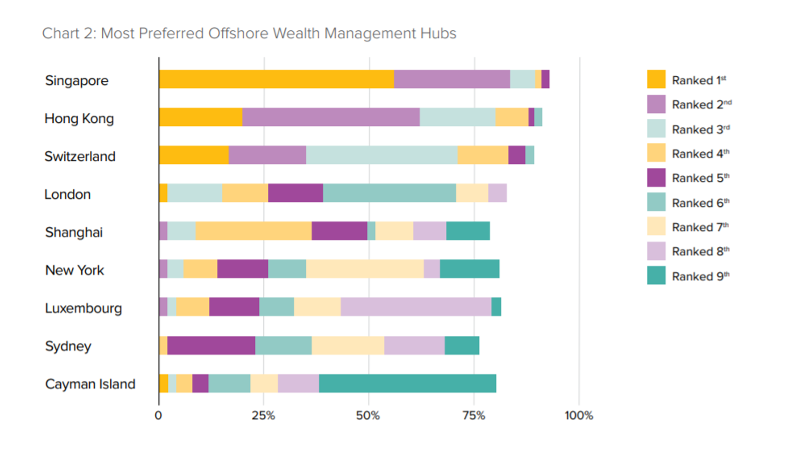

Singapore has an excellent reputation as a leading overseas banking jurisdiction for high net well worth individuals.

Telecom and mobile banking in Singapore are very innovative Although Malay is officially the nationwide language, English remains in reality one of the most commonly used and is the lingua franca amongst Singaporean citizens. There are limitations for US citizens for opening an account in Singapore, which limits the solutions and investment options available.

This makes it one of the most accessible overseas financial territories in Europe. Luxembourg is most widely known for their top quality financial investment financial services.

Getting The Offshore Wealth Management To Work

A Luxembourg overseas account can be opened up from another location within concerning 2 weeks. This is a little cost to pay for the range of benefits that a Luxembourg riches monitoring account deals.It is highly recommended to enlist the solutions check my source of a knowledgeable and also skilled offshore riches manager to assist my sources you evaluate and figure out one of the most suitable alternatives which are available to you. They can additionally make sure that the configuration procedure is smooth and also reliable.

Right here are several of the benefits of overseas asset administration that financiers need to understand. There are countless overseas depends on property defense that are particularly associated with the organization of safeguarding possessions. If a specific suspects that their money is at risk, they can rapidly transfer a portion of their wealth or properties to an overseas business for security purposes.

Getting The Offshore Wealth Management To Work

Offshore jurisdictions give the advantage of privacy legislation. A lot of the countries that are proffered for overseas banking have actually already implemented laws developing high standards of financial discretion. There have actually been severe effects for the offending parties in the past, specifically when discretion is breached. Revealing shareholders quantities to a violation of corporate confidentiality in some offshore territories.

In the case of money laundering or drug trafficking, offshore regulations will certainly enable identification disclosure. Overseas accounts to not have any kind of constraints (offshore wealth management).

They have actually proved to be some of the most rewarding markets where investors can rapidly diversify their financial investments. Coincidentally, many of the offshore accounts remain in developing nations where there are numerous investment chances and untapped see this site potential. A few of the governments are beginning to privatize a few of the markets, which is offering capitalists a chance to get significant financial investment chances in these growing customer markets.

Report this wiki page